This is a Budget not only designed to showcase the return to surplus (and by default the Government’s economic credentials) but engage voters with initiatives to make them feel like they are more prosperous. A massive infrastructure spend adds to this sentiment.

The Government has also stated that it will keep taxes as a share of GDP within the 23.9% cap.

All measures, of course, are reliant on the relevant legislation passing Parliament which is by no means a given with an election looming.

Budget 2019-20 Highlights:

- Personal tax cuts – $19.5bn package of personal income tax cuts

- Small business – Instant asset write-off increased to $30k and expanded to businesses under $50m

- Infrastructure – $100bn in infrastructure projects across all States and Territories

- Regulators – $1bn ATO task force funding targeting multi-nationals and high net worth individuals

What is missing from the Budget is any word or statement on the previously announced measures that would deny non-residents access to the CGT main residence exemption. Shadow Treasurer Chris Bowen recently released a media release calling on the Government to drop the “unfair ex-pat CGT changes.” So, unless the Government returns from the election with a majority, these changes will not come to fruition.

Individuals

Personal income tax cuts

As anticipated, the Budget celebrated the surplus with a $19.5bn package of personal income tax cuts for Australian residents. This package revises the legislated seven year income tax plan.

The personal tax changes mean a tax saving of $855 for someone on an annual taxable income of $45,000 per annum until 2022, then $1,080 until 2024 onwards (check the tax relief calculator).

| Tax thresholds | |||

| Tax rate | From 1 July 2018 | From 1 July 2022 | From 1 July 2024 |

| 0% | $0 – $18,200 | $0 – $18,200 | $0 – $18,200 |

| 19% | $18,201 – $37,000 | $18,201 – $45,000 | $18,201 – $45,000 |

| 30% | $45,001 – $200,000 | ||

| 32.5% | $37,001 – $90,000 | $45,001 – $120,000 | |

| 37% | $90,001 – $180,000 | $120,001 – $180,000 | – |

| 45% | >$180,000 | >$180,000 | >$200,000 |

| LMITO | Up to $1,080 | ||

| LITO | Up to $445 | Up to $700 | Up to $700 |

This round of tax cuts:

- Increases the top threshold of the 19% personal income tax bracket to $45,000 from 1 July 2022

- Reduces the 32.5% marginal tax rate to 30% from 1 July 2024-25

Low and middle income tax offset (LMITO) increased

| Date of effect | 2018-19 until 2021-22 |

The low and middle income tax offset (LMITO) will increase from a maximum amount of $530 to $1,080 per annum and the base amount will increase from $200 to $255 per annum.

The LMITO will provide a reduction in tax of up to $255 for taxpayers with a taxable income of $37,000 or less. Between taxable incomes of $37,000 and $48,000, the value of the offset will increase at a rate of 7.5 cents per dollar to the maximum offset of $1,080. Taxpayers with taxable incomes between $48,000 and $90,000 will be eligible for the maximum offset of $1,080. From taxable incomes of $90,000 to $126,000 the offset will phase out at a rate of 3 cents per dollar.

The LMITO is received after you have lodged your tax return.

Low income tax offset (LITO) increased

| Date of effect | 1 July 2022 |

From 1 July 2022, the Government will increase the low income tax offset (LITO) from $645 as legislated, to $700. The increased LITO will be withdrawn at a rate of 5 cents per dollar between taxable incomes of $37,500 and $45,000, instead of at 6.5 cents per dollar between taxable incomes of $37,000 and $41,000 as previously legislated under the plan. LITO will then be withdrawn at a rate of 1.5 cents per dollar between taxable incomes of $45,000 and $66,667.

One-off energy assistance payments

| Date of effect | Eligibility based on status on 2 April 2019 |

As previously announced, the Government will make a one-off payment to certain individuals to assist with paying energy bills and meet cost of living expenses. The payment will be exempt from tax and will be $75 for singles and $62.50 for each member of a couple.

The payments will be made to residents of Australia who are eligible for the following qualifying payments on 2 April 2019:

- Age Pension,

- Carer Payment,

- Disability Support Pension,

- Parenting Payment Single,

- Veterans’ Service Pension and the Veterans’ Income Support Supplement,

- Veterans’ disability payments,

- War Widow(er)s Pension, and

- Permanent impairment payments under the Military Rehabilitation and Compensation Act 2004 (including dependent partners) and the Safety, Rehabilitation and Compensation Act 1988.

More information

Medicare levy thresholds increased

| Date of effect | 2018-19 |

The Medicare levy low income thresholds for singles, families, and seniors and pensioners will increase from the 2018-19 income year.

| Thresholds | Current | Proposed |

| Singles | $21,980 | $22,398 |

| Family | $37,089 | $37,794 |

| Single seniors and pensioners | $34,758 | $35,418 |

| Family seniors and pensioners | $48,385 | $49,304 |

| Dependent child or student | $3,406 | $3,471 |

More information

Higher Education Loan Program cost recovery program delayed

Changes to the Higher Education Loan Program (HELP) set to commence from 1 January 2019, will now take effect from 1 January 2020.

The changes introduce a lifetime cap to prevent students who repeat courses or continually enrol in new courses from accumulating public debt with little hope of repaying the debt in their lifetime. The combined loan limit caps how much students can borrow under HELP to cover their tuition fees. The combined limit is $150,000 for students studying medicine, dentistry and veterinary science courses, and $104,440 for other students.

Superannuation

Superannuation ‘work test’ watered down & age limit for spouse contributions increased

| Date of effect | 1 July 2020 |

As previously announced, from 1 July 2020, Australians aged 65 and 66 will be able to make voluntary superannuation contributions (concessional and non-concessional) without meeting the Work Test. Currently, voluntary contributions can only be made if the individual has worked a minimum of 40 hours over a 30 day period (Work Test). Those aged 65 and 66 will also be able to make up to three years of non-concessional contributions under the bring-forward rule.

In addition, the age limit for spouse contributions will be increased from 69 to 74 years. Currently, those aged 70 years and over cannot receive contributions made by another person on their behalf.

Please contact us if we can clarify any issues for you.

More

Permanent tax relief for merging super funds

The current tax relief for merging superannuation funds is due to expire on 1 July 2020. The Government will extend this measure permanently.

The tax relief, which enables superannuation funds to transfer revenue and capital losses to a new merged fund, and to defer taxation consequences on gains and losses from revenue and capital assets, has been available since December 2008.

Opt-in insurance delay

The Government will delay until 1 October 2019, the start date for reforms that ensure insurance within superannuation is only offered on an opt‑in basis for accounts with balances of less than $6,000 and new accounts belonging to members under the age of 25 years.

Defence Force members can stay in super fund after discharge

Eligibility to Australian Defence Force Superannuation Scheme (ADF Super) membership will be extended to allow ADF Super members to choose to remain contributory members after discharge.

Business

Instant asset write-off increased to $30k and expanded to businesses under $50m

| Date of effect | 7:30pm (AEDT) on 2 April 2019 to 30 June 2020 |

The threshold for the popular $20,000 instant asset write-off will increase to $30,000* from Budget night until 30 June 2020 when it will potentially return to its original $1,000 level on 1 July 2020. We say ‘potentially’ because the threshold has been at or above $20,000 since 12 May 2015.

The Government had previously announced an increase to the threshold for the instant asset write-off to $25,000 from 29 January 2019 but this measure was not legislated prior to the release of the Budget. The Government however intends to honour the announced rate increase.

In addition, the number of businesses that can access the instant asset write-off will increase. Currently, to qualify for the write-off, only businesses with an aggregated turnover under $10 million qualify. From Budget night, businesses with an aggregated turnover under $50 million will also be able to access the write-off.

| Instant asset write-off thresholds | Small Business* | Medium business** |

| 1 July 2018 – 28 January 2019 | $20,000 | – |

| 29 January – 2 April | $25,000 | – |

| 2 April – 30 June 2020 | $30,000 | $30,000 |

* aggregated turnover under $10 million

** aggregated turnover under $50 million

Assets will need to be used or installed ready for use from Budget night until by 30 June 2020 to qualify for the higher threshold. Anything previously purchased does not qualify for the higher rate but may qualify for the $20,000 or $25,000 threshold. Similarly, anything purchased but not installed ready for use by 30 June 2020 will not qualify.

The instant asset write-off only applies to certain depreciable assets. There are some assets, like horticultural plants, capital works (building construction costs etc.), assets leased to another party on a depreciating asset lease, etc., that don’t qualify.

For assets costing $30,000 or more

For small businesses (aggregated turnover under $10m), assets costing $30,000 or more can be allocated to a pool and depreciated at a rate of 15% in the first year and 30% for each year thereafter. If the closing balance of the pool, adjusted for current year depreciation deductions (i.e., these are added back), is less than $30,000 at the end of the income year, then the remaining pool balance can be written off as well.

The ‘lock out’ laws for the simplified depreciation rules (these prevent small businesses from re-entering the simplified depreciation regime for five years if they opt-out) will continue to be suspended until 30 June 2020.

Pooling is not available for medium sized businesses which means that the normal depreciation rules based on the effective life of the asset will apply to assets that don’t qualify for an immediate deduction.

This initiative is subject to the passage of legislation so don’t go out on a spending spree just yet!

* $30,000

exclusive of GST for GST registered businesses.

$30,000 inclusive of GST for businesses not registered for GST.

Division 7A changes postponed

| Date of effect | 1 July 2020 |

Division 7A captures situations where shareholders access company profits in the form of loans, payments or the forgiveness of debts. The rules are drafted broadly and have become more complex as amendments close perceived loopholes.

Division 7A treats certain events as triggering “deemed” dividends for tax purposes. Where a private company makes a payment or loan to a shareholder or associate, the amount may be treated as a dividend for tax purposes. Where a debt owed by a shareholder or associate to a private company is forgiven, these amounts may be subject to the same treatment.

Significant changes to the way Division 7A works were intended start taking effect from 1 July 2019. These reforms have now been pushed back to 1 July 2020.

These proposed reforms include:

- While the current rules allow Division 7A loans to be placed under a 7 year or 25 year loan agreement, the new rules would only allow provide for a maximum 10 year loan agreement. Annual repayments of principal and interest would be required to prevent a deemed dividend from arising.

- Transitional rules would be introduced to ensure that all existing Division 7A loans are brought into the 10 year loan model. 7 year loans would retain their existing outstanding term. Existing 25 year loans would be largely exempt from the new rules until 30 June 2021.

- Loans made before 4 December 1997 that have not been forgiven (or deemed to have been forgiven) will be refreshed and brought within the scope of Division 7A. They will be treated as financial accommodation as at 30 June 2021 and will need to be repaid or placed under a complying loan agreement by the company’s lodgement day for the 2021 tax return to avoid a deemed dividend.

- The concept of distributable surplus will be completely removed, which means that the entire value of the loan, payment or forgiven debt will be an assessable deemed dividend regardless of the financial position of the company.

- Unpaid present entitlements (UPEs) will trigger a deemed dividend unless they are paid out or placed under a complying loan agreement by the lodgement day of the company’s tax return. Existing UPEs that arose between 16 December 2009 and 30 June 2019 will be brought within the scope of these new rules as well. Treasury is still considering whether UPEs that arose before 16 December 2009 should be brought within the scope of Division 7A.

- A self-correction mechanism will be introduced which will enable taxpayers to fix Division 7A problems without having to ask for the Commissioner’s discretion to disregard a deemed dividend. A number of conditions would need to be met in order to be able to take advantage of this (e.g., appropriate steps must be taken to fix the problem within 6 months of identifying the error).

- The amendment period rules for Division 7A issues will be extended to cover 14 years after the end of the income year in which the loan, payment or debt forgiveness occurred.

- Safe harbour mechanisms will be introduced in relation to the use of company assets where the parties are trying to show that the shareholder has paid an arm’s length amount for the use of the asset.

The postponement is a welcome move to provide more time for the measures. In some cases, there will be quite a bit of work to be done to implement the reforms.

We will let affected clients know more when more information is released.

Luxury car tax refunds increased for primary producers and tourism operators

| Date of effect | Vehicles acquired on or after 1 July 2019 |

For vehicles acquired on or after 1 July 2019, eligible primary producers and tourism operators will be able to apply for a refund of any luxury car tax paid, up to a maximum of $10,000.

Currently, primary producers and tourism operators may be eligible for a partial refund of the luxury car tax paid on eligible four wheel or all wheel drive cars, up to a maximum refund of $3,000. The eligibility criteria and types of vehicles eligible for the current partial refund will remain unchanged under the new refund arrangements.

North Queensland flood grants to be tax-free

| Date of effect | Grants relating to flooding between 25 January 2019 and February 2019 |

The Government will ensure that qualifying grants paid to primary producers, small businesses and non-profit organisations affected by the North Queensland floods will be treated as non-assessable non-exempt income, which means that they should be tax-free.

Qualifying grants include Category C and Category D grants provided under the Disaster Recovery Funding Arrangements 2018, and grants provided under the On-Farm Restocking and Replanting Grants Program and the On-Farm Infrastructure Grants Program.

Queensland storm payments to be tax-free

| Date of effect | Payments relating to storm damage in October 2018 |

The Government will ensure that certain payments made to primary producers in the Fassifern Valley, Queensland who were affected by storm damage in October 2018 will be exempt from income tax.

Increased funding for Export Market Development Scheme

$61m over three years has been provided to support Australian businesses to export Australian goods and services to overseas markets. $60m of the funding will go towards boosting reimbursement levels of eligible export marketing expenditure for small and medium enterprise exporters.

Compliance

$1bn ATO ‘sugar hit’ to tackle large corporates and high net wealth individuals

| Date of effect | From 2019-20 |

The Government will provide $1bn over four years from 2019-20, including $6.5 million in capital funding, to the ATO to extend the operation of the Tax Avoidance Taskforce and to expand the Taskforce’s programs and market coverage. For this, the ATO is expected to produce a $3.6bn budget gain.

Tax avoidance schemes and strategies are the focus of this funding.

Recovering unpaid tax and superannuation liabilities

An additional $42m has been provided to the ATO to recover unpaid tax and superannuation liabilities focussed on larger businesses and high wealth individuals. The measure is expected to create a budget gain of $103.6m.

$607m to follow through on response to Banking Royal Commission

$606.7m will be spent over 5 years to follow through on the Government’s response to the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. This includes:

These measures are partially offset by revenue received through ASIC’s industry funding model and increases in the APRA Financial Institutions Supervisory Levies.

ABN status stripped for non-compliance

| Date of effect | 1 July 2021, and 1 July 2022 |

From 1 July 2021, Australian Business Number (ABN) holders will be stripped of their ABNs if they fail to lodge their income tax return. In addition, from 1 July 2022, ABN holders will be required to annually confirm the accuracy of their details on the Australian Business Register.

Currently, ABN holders are able to retain their ABN regardless of whether they are meeting their income tax return lodgement obligations or the obligation to update their ABN details.

Support for small business in tax disputes

This previously announced measure provides $57m in funding over 5 years to provide access to a fast, low cost, independent review mechanism for small businesses in dispute with the ATO. The funding is directed to the Department of Jobs and Small Business, the Administrative Appeals Tribunal (AAT) and the Australian Taxation Office (ATO).

More information

Sham contracting unit established

A new dedicated sham contracting unit will be created within the Fair Work Ombudsman. The unit’s role is to address sham contracting behaviour by some employers, particularly those who knowingly or recklessly misrepresent employment relationships as independent contracts to avoid statutory obligations and employment entitlement.

Registration scheme for Labour Hire operators

As previously announced, a National Labour Hire Registration Scheme will be established to protect vulnerable workers, including migrant workers. The Scheme will make it mandatory for labour hire operators in high risk sectors, such as horticulture, cleaning, meat processing and security sectors, to register with the Australian Government as a labour hire operator. Annual fees and charges to participate in the Scheme are anticipated to cover the cost.

More information

International agreements

The Government has been busy securing international tax and trade agreements. We note these as Australia’s role in the region, security, and export markets rely on these agreements.

Australia-Israel Tax Treaty

The Government signed the Convention between the Government of Australia and the Government of the State of Israel for the Elimination of Double Taxation with Respect to Taxes on Income and the Prevention of Tax Evasion and Avoidance on 28 March 2019. The Convention relieves double taxation and lowers withholding tax rates on interest, dividend and royalty payments.

Australia Hong Kong Free Trade Agreement

The Governments of Australia and Hong Kong signed a free trade agreement on 26 March 2019. This agreement has not as yet been ratified. Under this agreement zero tariffs will be locked-in on goods, market access will be guaranteed for services suppliers, and conditions for two-way investment defined.

More information

Indonesia Australia Comprehensive Economic Partnership Agreement

The governments of Australia and Indonesia signed the Indonesia Australia Comprehensive Economic Partnership Agreement on 4 March 2019. The agreement reduces non-tariff barriers to trade and over time will allow 99% of Australian goods exports to enter Indonesia duty free or with significantly improved preferential arrangements. This agreement is yet to be ratified.

More information

More countries added to information exchange list

Effective from 1 January 2020, the following countries will be added to the list of those exchanging taxpayer information. As part of this, residents of these countries are eligible to access a reduced withholding tax rate of 15% (instead of the default rate of 30%) on certain distributions from Australian Managed Investment Trusts (MITs).

- Curaçao

- Lebanon

- Nauru

- Pakistan

- Panama

- Peru

- Qatar

- United Arab Emirates

More work and holiday visas for Indonesians

| Date of effect | 2019-20 |

The Government will seek to increase the annual cap for Work and Holiday (subclass 462) visas available to Indonesian citizens from 2,500 to 5,000 over a six year period from 2019-20 to 2024-25.

Other

$3.9bn Disaster response funding

Australia has seen its fair share of catastrophic disasters this year. In response, the Government has announced the creation of a $3.9bn Emergency Response Fund. The Fund will provide $150m per annum from 2019-20 to 202-24 following a significant and catastrophic natural disaster. This funding is applied where the disaster requires funding beyond relief measures already in place.

Climate solutions package

A previously announced $3.5bn package of measures will support Australia’s 2030 climate commitments. These include:

- Creation of a climate solutions fund to fund low cost abatement measures

- Increased funding for the Snowy 2.0 project and the Government departments that oversee it

- Creation of an Energy Efficient Communities Program to provide grants to businesses and communities

- Feasibility studies to accelerate the delivery of Marinus Link, a second interconnector between Tasmania and the mainland, to unlock pumped hydro storage potential in Tasmania

- Funding to improve household energy consumption

Energy infrastructure

$75.5m over 7 years will be provided for investment in network infrastructure, dispatchable generation and reliable energy supplies in the National Electricity Market.

The economy

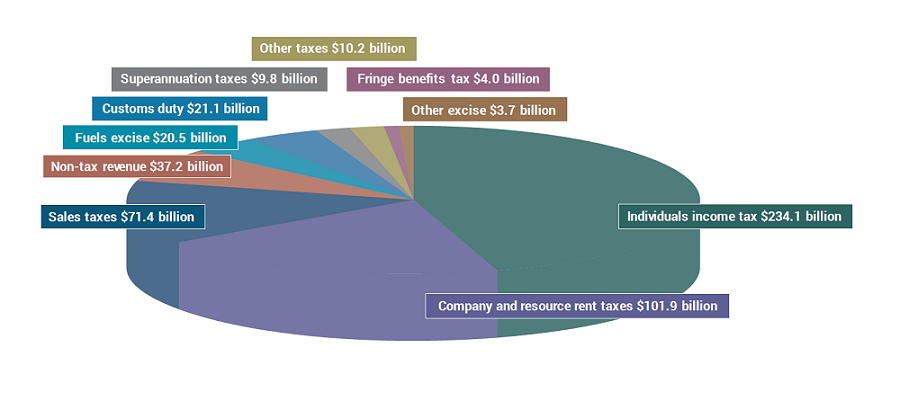

Where the money comes from

Source: 2019-20 Budget: Appendix B: Revenue and spending

Return to surplus

The jewel in the Government’s crown is the $7.1bn budget surplus in 2019-20. The Budget sets out:

- $11bn surplus in 2020-21

- $17.8bn in 2021-22

- $9.2bn in 2022-23

leading to the elimination of Government debt by 2029-30.

Growth in trading partners uncertain

The Budget notes continuing “uncertainties” around trade tensions, emerging market debt vulnerabilities and geopolitical issues.

With total trade covered by free trade agreements rising from around 26% to around 70% in the last 5 ½ years, you can see why there has been a flurry of activity to formalise trade terms with our regional and international partners.

Domestic growth solid but tempered

Australia’s economy is forecast to grow by 2¾% in 2019-20 and 2020-21. Jobs growth and economic stability is tempered by severe weather events and an anticipated decline in residential construction activity and house prices.